Kings And Queens of Digital Money

Africa’s financial landscape continues to undergo transformative change. At the heart of this transformation is a new breed of bold, tech-savvy, and visionary Nigerians who are breaking barriers and reimagining the future of finance. No longer content with the status quo, these innovators are building financial solutions that close the gap between the banked and the unbanked and place Africa at the centre of global fintech conversations.

Gone are the days when financial power was reserved for multinational institutions or exclusive boardrooms. Today, success wears a fresher face—one that looks like Tosin Eniolorunda, whose Moniepoint empire is driving financial inclusion across underserved communities; Ezra Olubi, whose role in Paystack’s $200 million acquisition made headlines around the world; Odunayo Eweniyi, who is turning saving into a cultural norm with PiggyVest; Eloho Omame, a powerful voice for gender-lens investing; and others who are proving that confidence, innovation, and purpose can be profitable.

These are more than entrepreneurs—they are financial architects building systems rooted in accessibility, transparency, and impact. Whether through digital payment platforms, investment tools, or funding ecosystems, they are reshaping how Africans interact with money and wealth creation.

This story celebrates those who are cashing in not just on currency but on courage. It is about the audacity to lead, to disrupt, and to succeed—on their own terms and for the continent.

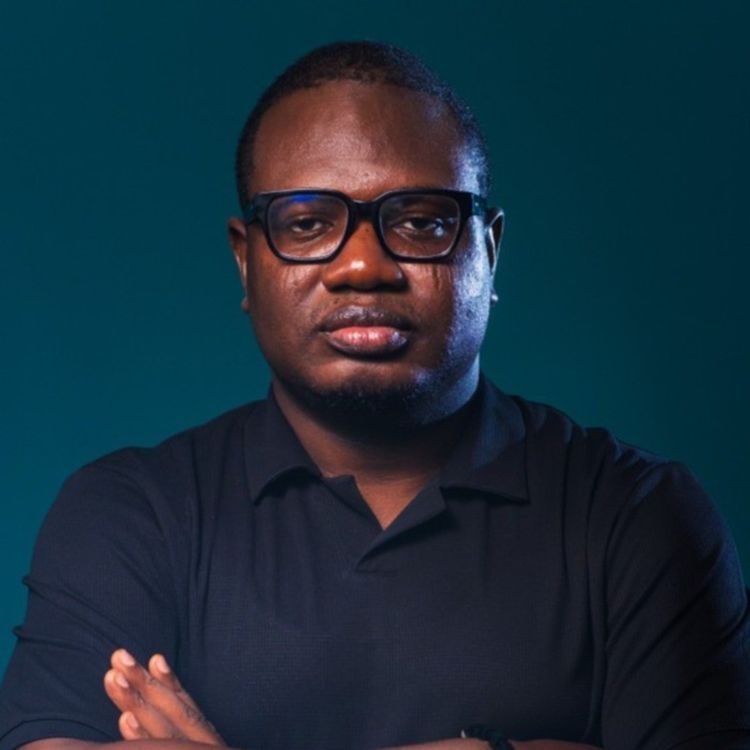

Tosin Eniolorunda – CEO of Moniepoint Inc

At a time when digital banking was largely focused on elite urban consumers, Tosin Eniolorunda took a different path—he bet on everyday Nigerians. As the Founder and CEO of Moniepoint Inc. (formerly TeamApt), Tosin has emerged as one of Nigeria’s most influential fintech leaders, building financial infrastructure that serves real people and real businesses, particularly in underserved communities.

Under his leadership, Moniepoint has grown into one of Africa’s largest business banking platforms, powering over 1.6 million businesses with everything from payments to working capital. The company processed over $182 billion in transactions in 2023 alone, making it one of the continent’s most important yet understated fintech giants. Eniolorunda’s vision goes beyond sleek apps and startup buzz; it’s about solving problems at scale—whether it’s enabling a market woman in Kano to accept digital payments or helping small businesses stay afloat with accessible credit.

Eniolorunda is proof that confidence doesn’t always look like noise. Quietly impactful, he has built a robust digital backbone for financial access in Nigeria, and he’s doing it sustainably. With a strong emphasis on operational excellence and compliance, Moniepoint stands out in a crowded fintech space for its focus on long-term value.

Tosin Eniolorunda has flipped the script in breaking the finance glass ceiling: success isn’t just about disrupting banks—it’s about building systems the banks forgot. He is, without a doubt, one of the most pivotal players in Africa’s financial evolution.

Shola Akinlade – Co-founder & CEO, Paystack

As the Founding Partner and CEO of Paystack, Shola Akinlade has become a defining figure in Africa’s fintech landscape, reshaping how businesses and consumers exchange value across the continent. Co-founding Paystack in 2015 alongside Ezra Olubi, Shola’s visionary leadership turned the startup into one of Nigeria’s most successful tech companies, culminating in a historic acquisition by Stripe in 2020, marking one of the largest tech exits in Africa.

Shola’s impact goes beyond numbers and milestones. At a time when Africa’s digital economy was still nascent, he recognised the critical need for a simple, reliable, and secure payment infrastructure. His work has empowered thousands of small and medium-sized businesses to access global markets and grow their customer base, fueling entrepreneurship and economic development.

His story fits perfectly within the theme of this article. Shola embodies the new generation of African leaders breaking the finance glass ceiling by innovating within the fintech space and creating platforms that democratise access to financial services. His ability to blend technology with deep market insight has helped demystify digital payments for millions, making finance more inclusive.

In redefining success and breaking barriers before the age of 40, Shola Akinlade exemplifies how confidence, expertise, and visionary thinking are transforming Africa’s financial future—one seamless payment at a time.

Odunayo Eweniyi – Co-founder & COO, PiggyVest

In a country where financial literacy is low, and saving culture was once non-existent among young people, Odunayo Eweniyi saw a gap—and filled it with purpose, innovation, and tech. As Co-founder and Chief Operating Officer of PiggyVest, she has played a defining role in revolutionising how millennials and Gen Z Nigerians manage their money.

Founded in 2016, PiggyVest began as a digital piggy bank and has since grown into a full-fledged personal finance platform, helping over 4 million users build discipline, save consistently, and invest wisely. Eweniyi’s strength lies in her operational brilliance, transforming a simple savings idea into a financial lifestyle movement. By leveraging gamification, social media, and relatable money narratives, she made finance accessible and even enjoyable for a generation often excluded from wealth-building conversations.

But her impact goes beyond tech. Eweniyi is also a powerful voice for gender equity in African business and tech spaces. Through initiatives like FirstCheck Africa, she supports female-led startups, helping women gain access to early-stage capital and mentorship. Her dual commitment to innovation and inclusion makes her one of the most respected and fearless young leaders in African finance today.

Eweniyi fits perfectly into this story—not just as a disruptor but as a builder of new systems that include more people, especially women. Her work reflects a deeper truth: breaking the finance glass ceiling isn’t just about numbers; it’s about shifting culture. And in that regard, Odunayo Eweniyi is miles ahead.

Eloho Omame – Founding Partner, FirstCheck Africa

When it comes to reshaping who gets funded in Africa’s tech and finance ecosystem, Eloho Omame is at the forefront of the revolution. As the Founding Partner of FirstCheck Africa, a female-led angel fund and syndicate, she is on a mission to rewrite the investment narrative—one where African women aren’t just building startups but are also backed with capital, confidence, and credibility from day one.

Omame’s journey through investment banking, private equity, and startup incubation gave her a front-row seat to the gender disparity in funding. Rather than wait for change, she decided to lead it. With FirstCheck Africa, she’s creating an inclusive pipeline that prioritises early-stage support for female founders, providing both capital and mentorship to close the gender gap in African venture funding.

Her impact is multidimensional. Omame is not just writing cheques—she’s influencing a shift in how the finance world views leadership, innovation, and risk. By backing underrepresented voices, she’s proving that women-led ventures aren’t a charitable cause; they’re a sound investment strategy.

In a world where access to capital remains one of the toughest glass ceilings, Omame is swinging the hammer with intention and intelligence. She belongs in this story not only because she’s helping women break into finance, but because she’s redefining the rules of who gets to play—and win. Her vision is bold, her work is catalytic, and her presence is pushing Africa’s financial future toward greater equity.

Razaq Ahmed – Co-founder & CEO, Cowrywise

In a financial landscape long dominated by gatekeepers and limited to the wealthy elite, Razaq Ahmed emerged as a trailblazer who dared to democratise wealth-building. As the Co-founder and CEO of Cowrywise, Ahmed has built a platform that brings investment opportunities once reserved for the rich into the hands of everyday Nigerians—young, old, salaried, or self-employed.

Cowrywise was born out of a deep understanding of the financial exclusion many Nigerians face, particularly when it comes to long-term investing. Ahmed, a trained economist and former investment analyst, combined his technical know-how with an empathetic grasp of local financial behaviours to build a product that simplifies savings and investment. Today, the platform boasts hundreds of thousands of users and partnerships with top asset managers in Nigeria.

Ahmed’s brilliance lies in bridging trust and tech. In an environment riddled with Ponzi schemes and mistrust in financial institutions, he has created a transparent, secure, and user-friendly product that empowers users to take control of their financial futures without jargon or intimidation.

His inclusion in this feature is a no-brainer. Ahmed isn’t just making finance accessible—he’s changing the culture around money management in Nigeria. Through Cowrywise, he’s showing that confidence in finance isn’t reserved for bankers in suits; it’s something every Nigerian can—and should—own. In breaking the glass ceiling, Razaq Ahmed is making sure there’s a ladder underneath it, too.

Olu Akanmu – Former President & co-Ceo, Opay Nigeria.

Olu Akanmu’s name carries weight in Nigeria’s financial and digital sectors, not just for what he’s built but also for the bold spaces he’s occupied along the way. As the former President and co-CEO of OPay, he brought traditional banking acumen to one of Nigeria’s most disruptive fintechs, playing a pivotal role in scaling the company during a defining moment in Nigeria’s digital finance evolution.

With an impressive background spanning telecommunications, marketing, and commercial banking—including roles at FCMB, Airtel, and MTN—Akanmu brought a rare versatility to the fintech table. Under his leadership, OPay became a household name, offering seamless payment and financial services to millions of Nigerians, particularly during the country’s 2022/2023 cash crunch. His ability to lead with vision and stability helped the company navigate a volatile financial climate while continuing to expand its market share.

What sets Akanmu apart—and justifies his place in this story—is how he straddles the line between institutional know-how and modern innovation. Even amidst corporate clashes, his push for social impact and consumer-focused branding within OPay reflects a broader ethos: finance should work for the people, not just profits.

Though he stepped down from OPay in 2023, Olu Akanmu remains a force in African fintech conversations. His journey underscores a new wave of financial leadership—one that merges credibility with creativity and tradition with transformation. He’s not just breaking the glass ceiling; he’s redesigning what’s on the other side.

Chima Nwosu – CEO, Palmpay

Chika Nwosu is a prominent Nigerian business leader and the Managing Director of PalmPay, one of Nigeria’s fastest-growing digital financial platforms. With a strong background in business and technology, Nwosu has played a vital role in advancing cashless payments and digital banking across the country. Under his leadership, PalmPay has grown rapidly, offering millions of Nigerians access to secure, easy, and convenient financial services through a single mobile app.

Since taking the helm, Nwosu has overseen PalmPay’s expansion to over 35 million customers and 1.2 million business users, making it a trusted name in the fintech space.

Committed to user safety, Nwosu has championed initiatives such as the Wallet Safety Workshop to combat online fraud. With ambitious plans to expand into other African markets and Southeast Asia, Nwosu is positioning PalmPay to shape the future of digital finance not only in Nigeria but globally. His leadership reflects innovation, resilience, and a customer-first approach to financial inclusion.

The stories of these Nigerian finance leaders are not just individual wins—they are indicators of a larger, irreversible movement. What we’re witnessing is a conscious reshaping of power dynamics in Africa’s financial ecosystem, where access, innovation, and impact are no longer restricted to traditional gatekeepers. These visionaries are not only creating solutions that resonate with millions—they are also widening the door for others to walk through.

Their work reflects more than personal ambition. It reveals a commitment to collective progress, where finance becomes a tool for empowerment rather than exclusion. In an industry once defined by conservatism and elitism, these changemakers have brought humanity, diversity, and approachability into the equation. They’ve redefined what leadership looks like—and who gets to lead.