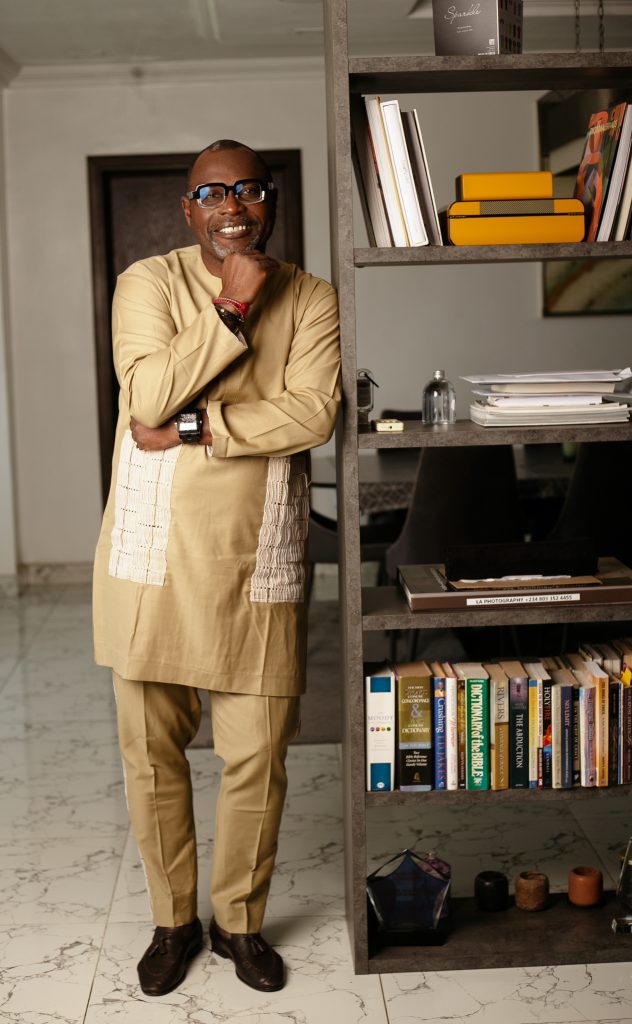

Kola Karim’s Optimistic Perspective

The oil industry in Nigeria has long been a source of great potential and significant difficulties. Although it has boosted the country’s economy, it has also faced challenges related to sustainability, governance, and shifts in the global market. Kola Karim, the CEO of Shoreline Group, stands out as a ray of hope and innovation amid this complicated situation.

Businessman Kola Karim has led an exceptionally amazing career. His broad portfolio, which encompasses oil and gas, power production, construction, commodities trading, and telecommunications, has had a big impact on the nation’s corporate landscape. Recently, he was appointed as the Chairman of British American Tobacco Nigeria’s Advisory board.

Kola Karim talks about his experience in the Nigerian oil industry in an interview with TheWill DOWNTOWN’s Executive Editor, Onah Nwachukwu, giving light on how innovation and forward-thinking tactics can bring about a new era for this vital Industry.

Tell us about the origin of Shoreline Group.

Shoreline Group was founded as an offshoot of my mother’s trading company in 1987. I moved back here in 1993 and started working in that business. It was mainly an export business, general trading of palm kernel cake, export to European feed millers, making animal feed, chicken feed, and horse feed because of the rich oil content of Nigerian expellers. So when you crush palm kernel, oil is extracted. The nuts are cracked. What is left, the shaft, is what is called palm kernel cake. Traditionally, because of the inefficiencies of Nigerian equipment in crushing, you still have about 50% of oil left in it. So the Europeans bought that because of the very rich content in making feed for animals. That’s the basic origin of the company. We started building from there, from our export business, Abacha’s government, if you remember then, said if you bring your foreign exchange if you want to export, you have to sell it to the bank. But you’re allowed to import with your foreign exchange. And that’s what brought us into importing equipment and machinery into Nigeria. So we export palm kernel and ginger and take the money and import equipment and machinery. So that’s bulldozers, generators, just heavy-duty machinery that we could sell here. So that’s the base origin of what you see today and what we started driving.

Between ideation and implementation, did you ever foresee it being as successful as it is?

With everything, you have God first. And I don’t think anyone goes into anything not wanting or wishing for success. But what was true is you have to be self-conscious of the environment you work in. And we were determined to build a successful business. And Nigeria also was the right environment. People checked out, but some of us checked in, and people thought we were mad because we were checking back in. A lot of people thought I was crazy. I was working for an oil exchange in London, a great job, and I packed it up to come back here. And everyone thought I was mad, but it was fun, and it’s still fun. And my belief in Nigeria has been second to none. And that commitment to what opportunities Nigeria has amid all the madness is still an important factor.

You have masterminded the birthing and nurturing of successful businesses across sectors. What’s the first thing you always consider before delving into a business?

First, let me say this. Most of the businesses we’ve done, other than the first one that was deliberate because of businesses we met, the rest were just opportunistic. And that’s the fact. It wasn’t because, oh, we set up to go into oil and gas, or we set up to go into power or infrastructure. It was just opportunistic because, at the time, Nigeria needed those services and those businesses, and we were in the right place at the right time. Ability to take in those businesses and opportunities and actualise them. That’s what it is. So I always listen to people that say it wasn’t deliberate. I’ll give you an example. In 1999, when democracy kicked off again in Nigeria, the power situation was just terrible, and when that happened, the president then, President Obasanjo’s wish was to push and get power into Abuja, and they contracted a company called Aggreko. Aggreko is an international power rental company that we were working with. I had a very old friend of mine who contacted me from London and said, “look, we’ve been approached by Nigeria to come and provide 50 megawatts in Abuja. But we don’t know Nigeria. Do you mind working with us?” So that’s how that was birthed. So it wasn’t that we planned to go into power. Then, dovetailing from that, when the power was procured, there was a company called ABB, which was contracted to build the power distribution and the step-down transformers to make sure the power was distributed properly in Abuja. Again, by virtue

of Aggreko’s interface with them, I was interfacing with the CEO Paul Meyer. They got into international problems, with nothing to do with Nigeria. And jokingly, Paul said, we’re having serious problems with a case that they were investigating, and they got fined by the US Stock Exchange, New York Stock Exchange. So I said to him, look, if you’re worrying yourself, I’ll buy the business. Just jokingly. So three weeks later, the guy called me and said, Kola, remember what you talked about, about buying our ABB Electrical Systems business in Nigeria? Look, I’ve spoken to my bosses. We’re interested. We need to announce that we’re exiting Nigeria. But we’ll still provide the support for you and give the business to you. That’s how we bought the ABB Electrical Systems business. So again, out of good fortune, and necessity, it was deliberate. And they already had work because we were already working on building the distribution network in Abuja. So that’s the interface of that. Fast forward to our oil trading business. Again, when you say oil trading, it’s an opportunistic business. It’s a government business. It’s not a business that you set out. Why? Because you get an oil allocation.

You sell an oil allocation. You import what is needed, be it products, into the country. So that’s oil trading. Buying and selling. So if you have relationships in relationships, you get allocated. You sell the allocation. You bring what they ask you to bring. You bring in products. It’s oil trading. It’s basic business. There’s nothing sexy around the creativity of oil trading. Again, opportunistic. Why?

If you don’t know anyone, you won’t get anything. You can’t be sitting in Port Harcourt, in Benue and be saying I’m an oil trader, and they’ll say go and call him and give him three allocations of cargoes or crude.

You should bring four gasoline cargoes. So, let’s speak it as it is. That’s opportunistic. Again, it’s a favour. It’s not deliberate. Talking of construction, construction was more deliberate because we’re already shareholders. And that focus, Nigeria was going through a renaissance of rebuilding from water treatment plants to hardcore infrastructure, real rehabilitation, and stuff. We saw that opportunity. So we went into that as well. Then fast forward, which is now our largest business, oil and gas. Remember, in 2007, the push in the Delta with the security threats, the international oil companies were shutting down assets, and Nigeria was suffering. And the president said, if you do not operate those assets, we’re going to take them away. So, the oil companies were very smart. What did they do? They decided they were going to sell these assets to Nigerians. Again, it was forced by a situation. It wasn’t a deliberate thing. So if you look at all of us, the local oil companies, (the LOCs) today, nobody would tell you, oh, I set out in 1990. I was going to be an oil company. No, that’s not true. It was a situation of the Delta that forced the IOCs to sell those assets. And in the process, the government said, if you will sell, Nigerians must participate.

That’s what birthed Seplat, Shoreline Natural Resources, ITO, and all of us. So I read stories sometimes, people make up these stories, it’s not true. At all.

The reality is that we were lucky, being at the right place at the right time in the right business, and the opportunities came, and we were able to jump on it. That’s all it is. Look, Nigeria, as an emerging economy, will always shoot up opportunities. And those opportunities will throw up huge players in various sectors. This was 2009, 10, 11, 12, the first wave of divestments. And that’s where we all participated. So that’s what made the changes in the companies you see today. Then, fast forward, you saw the power sector.

Look, because we’re all emerging enterprises, remember we bought assets from established players, Shell, Total, and ENI. These are players who have been operating for 70, 80, 90, and 100 years. Most of us have been operating for 14 years, max. So you can’t compare to how many of us locals have the balance sheet of these global players. We do not. So we’re using what I call bootstrap financing to play a big boy’s game. But it will get better. That’s all it is. So where I’m going is opportunities in an emerging economy like Nigeria would always beckon because the gaps are always going to be there. By global restrictions alone, international businesses, global businesses, I don’t see them as retracting from emerging economies like Nigeria. So the other day, there’s a big hoopla that GSK is leaving Nigeria. They’re not stupid if they were making huge money here. But that’s an opportunity for another group of Nigerians to look at the void of the business they’re leaving. And jump in there to take that opportunity. So, I don’t see things as a negative per se.

It’s just, are there people who are watching, viewing, to see if we can fill the void and grab that business? Look, one of the biggest businesses I’ve followed over the years is Noodles. In 1992, and 1993, you didn’t see people eating noodles. But this guy saw a void. It was a huge meal in Indonesia. Indo-foods.

Indo-mie. But they saw a void because people wanted to eat quickly. And they thought this would make sense in Nigeria.

And look at it today, that’s a gazillion-naira business. Those guys saw the void. So, in economies like here, there are voids all the time. I’ll give you an example of a business that people don’t understand. But this business is so huge.

Gala. Snack. You wouldn’t believe the quantities of Gala sold in Nigeria per day. So it’s the opportunity that beckons. And this is what favours the brave, right? What we’ve learned in Nigeria, as a businessman running a reasonable-sized group, is we sniff around opportunities. Our latest one is our deep focus on concessions infrastructure because the next wave of government anywhere in the world will never have the required capital to develop infrastructure as the populace wants needs, or deserves it— everywhere in the world. Nigeria will never be an exception. So, if you want it, someone’s got to pay for it, and the private sector’s got to participate to drive it because they’re the only ones that can attract the capital. Look, the government is just saying to us that Nigeria cannot afford any more borrowings. But are you saying we will not develop and we’ll be stagnant for the next couple of years? Again, opportunities. If you see an opportunity and you can raise the required capital, why should the government stop you? Because you’re going to be creating jobs, you’re going to be paying taxes. So the government and private sector are married. It’s interwoven. See, the success of any government without a vibrant private sector is a failure.

Because who’s going to pay the taxes? Who’s going to pay the people? See, the government employs so much, but the private sector employs this much. Because those are the drivers of the economy. This is why I always say to the press that they have a huge part to play, always, in the success or failure of any entity called government. Because if not, what happens is people’s expectation is high. Rightly so. In a society where you have fuel subsidy, fuel subsidy that you and I do not know the amount that’s been consumed. But they just tell us every year they’ve spent $12 billion to subsidise fuel. But let’s go back to brass tacks. Who are the people being subsidised? How many poor people have one, two, or three cars? So they’re subsidising you, me. Right?

Have you noticed since the subsidy’s been gone, traffic has gone down? Do you think those cars that disappeared from the road belong to poor people? There you go. So people are now being watchful. If you have three cars at home, traditionally, one will take the kids to school, another will take Madam to the market, and another will take…because the government is subsidising me for my lifestyle. Because John, Ade, and Ngozi are taking public transportation. Those are the people that deserve it. So now, what has happened, is Kola Karim uses one car that will drop madame at work, then drop me and take the kids to school. So reality’s setting in. That’s all it is. So excesses, that’s one. The other one is foreign exchange. How does it make sense that you, who have a business, cannot buy dollars at $460, and someone can sit in their house and get dollars at $460, and they sell it at $780 to you? That’s trying to use it for your business. Do you see the difference? There’s a distortion. So when you create a rentier state, where we can sit here, because we know him, and we can make gazillions, you create a distortion in the economy. So getting rid of those two critical indices, it’s hard now, it’s very difficult. And rightly so. But I kid you not, if we stay the course, in the next six months to eight months, those monies saved could then be filtered back into the system because the money is something you and I can never quantify because we weren’t getting it anyway. So the last part of what I saw as a big distortion in where Nigeria is today is the oil which produces 89% of our foreign exchange. What has happened to oil production in the last three years? Production has just been going down. Today, Nigeria is producing 1.2 million barrels. We were at 2 million. We started at 2.5 million. I broke it down to someone yesterday, I said listen we can all sit here and cry to blue murder. If your household earnings used to be 2 million, and you’re spending 2 million, and your household income drops to 1 million or 800,000, two things have got to give. Either from when you were eating three times a day, you cut it down to eating once a day, with electricity you start using a fan instead of AC, something’s got to give. That’s why I go back to the explanation. Nigerians are very reasonable people. If you explain it the way they understand it, it’s not that everyone has a criminal intent anywhere.

If you explain it, people will understand it.

Because rationally, I had an interview on Arise TV on this fuel thing. A lot of people call in that; now it makes sense. Because it’s very simple. Mr. Joe, the government is trying to help you. You’re the one that needs the subsidy. But the majority of the subsidy is going to people like us. The middle class and the upper class. Some homes have 10 cars. They’re fueling it at 160 naira. That’s why you can send one here, and send another one to go and buy pepper. That’s what it is. But that’s the difference. So, I see an opportunity in the whole madness. Today, the government is talking about CNG; Nigeria has 210 TCF of gas reserves. Now, let me explain this so we can understand how crazy we are as a country. Qatar is a tiny country of 350,000 people. And when you talk of Qatar, the world talks about their gas and how many trains of LNG they have. They’re on the 20th train. Total reserves of gas they have. Remember, they’re intentional. All they do is gas, 498 TCF. So Nigeria has not touched its own. We’ve just locked it there. We have 210. Nothing’s happening to it. So, do you see what I’m saying? Nigeria’s fortune is the easiest to turn around.

You need deliberate, purposeful leadership. That’s drilling down focus in making that happen. Let me give you an example. Nigeria has six trains of LNG, several trains taking them how many years to approve? Imagine if in 2003 we had built BRASS, five trains. We built OK LNG, five trains. Nigeria would have 16 trains of LNG today. Do you know what that means? That means cash is coming to the Nigerian pocket. At a minimum, Nigeria would be making three to four billion dollars a month.

With 16 train LNG. See, let me give you numbers that will shock you. Russia was supplying a billion dollars of natural gas per day to Europe. A billion dollars, north stream one and north stream two. A billion dollars per day, and they have about 560 TCF of gas. So imagine if the pipeline going to the Sahara was built. The one going towards Morocco was built. On my calculation, Nigeria would be making nothing less than 300 million dollars a day. Selling gas to those countries in Europe. You see, why I do say we are a crazy country? You have the reserves. It’s not that you’re looking for it. You have it. It’s there. It’s madness. You just need leadership and the right enabling environment.

At 300 million dollars a day, I’m telling you, Nigerians will be the proudest place. People will be rushing back here. Nigerians, listen, I kid you not, will be building trains, building subways, building everything. That’s why I can’t understand why people cannot see this.

Look, the Russia-Ukraine war.

Today, who are the two people benefiting? America. Because they’ve become the largest suppliers of LNG to Europe.

A substitute for the ones not supplied to Europe by Russia. And countries like Nigeria should be making a fortune. Saudi Arabia is making a fortune.

But why? We are doing the opposite.

Instead of our production increasing while the UAE is ramping up, Saudi Arabia is ramping up. Even Iran, with all the sanctions, is trying to ramp up, and Nigeria is going down.

So why is Nigeria going down?

Look, let me explain the oil industry. If you’ve got a well producing, there is a natural decline cup of 5% a year, so if we say Austin, you have a company that is producing 10,000 barrels, if we don’t put any money 1000/ by 5% in a year, the following year, and the following year, it is the lack of investment in the Nigeria oil and gas that is 2010, 2011, so do the sums. It’s not rocket science.

Why is this?

Look, first is the international oil companies. It took the bill over 20 years to be passed. In any sane country, 89% of your natural earning dollars is from that sector.

And you’re dealing with international companies that follow the rule of law. And you spend 20 years in passing the law that would guide their future. Do you see the problem? So those guys just say, hey. Because what is the PIA? The PIA would then bail. There was talk about your royalty would go up from 10% to 20%. It would go up to 15%. Would you put money? When you’re in uncertainty. Right?

So, these guys did not invest money.

Then the Niger Delta crisis started.

And the guys said, I don’t want wahala, my people being kidnapped. They shut down the wells. That’s the problem. So indecision, being indecisive, has driven a wedge. You see, the oil industry and the people leading the oil industry must understand one thing. Global capital is looking for returns. So the guy who is the chief financial officer at Exxon, sitting in Houston, is saying, hang on. Why am I going to allocate capital to Nigeria when I don’t know what my effective rate of return will be? Let’s put it in Guyana. In that time, Guyana, by 2027, will produce a million barrels a day. That’s a country of 700,000 people, by Exxon. So why wouldn’t they sell Nigeria? Why wouldn’t they sell Egypt? You see, it doesn’t matter what business. There are no sentiments. There’s no return for your investors. So if someone is not giving me the right message, then I’ll go somewhere else. Nigerian leadership has forgotten that oil is no longer the preserve of Nigeria.

They’re finding it everywhere. In the 70s and 80s, we were very proud. We were the largest oil producer in Africa, fifth in the world, yada, yada, yada. Ghana found oil now. Equatorial Guinea found oil. Are they not producers? Angola found more. Namibia, Mozambique, and Senegal found gas. Now, Cote d’Ivoire. Do you see?

So what used to be our preserve in Nigeria is no longer what it is. And we’re still faffing around, PIB, this, 20 years. Do you see the problem? The guy goes to Ghana. He puts his money in Ivory Coast. He goes to Namibia. You need to show seriousness to international business looking for a return with purpose.

If not, forget it. So this is what, again, this is what is behind. We must know in the collective that people who would lead sectors that are critical to any economy, should take it seriously that there are people who not only of notes but understand what they’re doing. I always go back to an example. If you and I know that the pilot that’s going to fly the plane that we’re going to board to Abuja or Port Harcourt is a learner, would you enter? So why do you put the most critical part of our economy (this is historical) in the hands of charlatans and mediocre drivers? Going back 20 or 30 years, why don’t we get the best in class globally like everyone does? So I don’t understand it. This is the most important: 89% of the dollars this country earns is from this thing. It makes no sense. So I think that’s why I say we’re mad. If we will not get onto a plane, that is life and death, so that tells me two things. Either we don’t take the dollars that Nigeria earns as life and death for the economy, and that’s why we’re all suffering today. So, all of us, we’re to blame. That’s important.

Do you remember your first contract with the government?

Oh, it’s very interesting. It’s, again, oil trading.

Again, as I say, it’s favour. It’s not out of being smart. People make applications to lift the price of fuel oil in the 90s, and you get the opportunity, you get the approval to lift, and you sell it, and you make money. So when you say government contract, that’s one. Others of note are major construction contracts that we’ve handled, like the Tamburawa water treatment plant in Kano and the Watari Water Treatment Works. In the early 2000s, those were in the $200 million marker size of contracts. Again, these are projects of note. Anytime you drive past it and look at it, you say, wow, we did this. That’s very, very interesting when you see it. And that’s, for me, one of the big joys I get about infrastructure. You look at it many years after you say, wow. See, people that did Eko Bridge 70, 80 years ago, Falomo Bridge, you can still point to it.

Anytime you talk about Falomo Bridge, you talk about General Mobolaji Johnson, who was at the fore of it.

Third Mainland Bridge, you talk about General Babangida, who completed it. So those, for me, are the real drivers of infrastructure that gives me joy.

In your opinion, what is the surefire way for the present government to improve Nigeria’s economic fortune?

Easy. If 89% of our foreign exchange is from a certain sector, which is oil and gas, I will put 200% of my time into oil and gas and make sure it works. Look, the shortest and quickest way for Nigeria to earn dollars is oil and gas. Look, if we’re saying cocoa, I love diversification. Diversification is good. Everybody knows if we export cocoa, we make money. How long would it take a cocoa plantation? If we talk about groundnuts, how long would it take us to plant groundnuts? If we talk about food, how long is it going to take maise to grow? It’s good. But what we have in our backyard that’s there is oil and gas. There should be a task force breathing, sleeping 24-7 in the president’s office, sitting on this 24-7, because that’s the fastest means. Let me give you a typical example so Nigerians understand the quantum of this. Nigeria earns a 20% royalty on every barrel of oil produced. If we produce 1 million barrels, Nigeria gets $100. Nigeria gets $20 a barrel. This is excluding taxes and everything. This is just straight up.

So imagine if we produce 2 million barrels, we get 20 times 2 million. If we produce 3, that’s 20 times 3 million. Do you see how it’s quick to fill up the coffers with money? That’s all it is. It’s just very simple mathematics. Very simple.

You won the concession of two airports, the Nnamdi Azikiwe and Malam Aminu Kano. What drew your attention to the aviation industry?

Look, for every Nigerian who travels to our airports, when you look at the quality of the airport and the quality of the services at the airport, and you go to even other African countries, you cannot compare. And that, for me, was a huge void. If you go to Kotoka, go to Ivory Coast, look at the quality of the airport and the quality of services. And Nigeria has 200 million people. And if you look at the dynamics of Nigeria’s population, if over 60% is under the age of 35, that tells you that’s the travelling public and the growth in travel. So they deserve a very good experience. So we saw the opportunity when the government advertised, and we went out to look for the right global partner that could deliver the right quality service, but a global partner that’s worked in economies and climes similar to ours. And that is how we partner with the Corporate CEO of America. They run the majority of the airports in Latin America. Most of those economies, as you know, are emerging. In Europe, in emerged economies, and Central Asia. These guys are New York listed, so all global norms and standards are followed, and they understand the business, and we were fortunate to have them come with us to Nigeria, to Kano and Abuja airports.

As Chairman of the Board of Costain West Africa, how do you balance your role there with your responsibilities as CEO of Shoreline?

Look, being the Chairman of a Board is non-executive. I chair a majority of the companies. I run the group, and it’s my focus to make sure every business of ours is delivering value. So, on the construction side, not only Costain, we have Mota, and Mota is the third largest European construction company as well, which is now in Nigeria. And we’re the ones building the Kano Maradi Rail. We’re the ones who won the Shagamu – Benin expressway. The Lagos-Badagry to the border expressway. These are global companies of repute, listed in Euronext, and with their drive and focus on Nigeria, the Mota Board sees the infrastructural gaps in Nigeria. And someone’s got to do it. So they’ve got a balance sheet, global know-how, and the ability to make things work. We just won the Benin Port project as well. So there’s a lot of opportunities. So, my time chairing all these boards and sitting in the group is being able to direct this to purposeful, not only delivery of values to shareholders.

So you’ve held several positions on boards. How do you manage your time and expertise effectively across these companies?

I’ve been very lucky. I think, as a young Nigerian, I was very, very lucky to get to sit on global boards. An example, I got to the board of Ecobank at the age of 37. I was the youngest by far. At the age of 34, I sat on the board of Schlumberger. So, on the international side, I sat on the London Stock Exchange Africa Advisory Board. I sit on the Harvard Kennedy School Board, and the Dean’s Council. I sit on the Center for Africa Studies Board as well on the international side. I sit on the African American Energy Chamber Board. So over the years, the experiences from Nigeria, sitting on those boards very early, I could understand very well what it is to drive value. I sit on the Leventis Board,( the AG Leventis Board). So we’re very, very fortunate because the experiences of sitting on boards in Nigeria are second to none. You understand the good, the bad, and the ugly. And that’s helped me shape my mindset.

In your opinion, what qualities or skills are essential for a leader to successfully oversee multiple companies and industries?

You have to be true to yourself first as a leader. You have to be true to yourself. You cannot lead if you have self-doubt in yourself. You lead from the front, and you lead by example. And that’s what I see. I’ll give you an example. As a leader, if people who work for and with you see you stealing from your own company, and you want them to stay truthful, there’s a simple flaw. When you call your staff and say, ah, they want to supply those cars, why don’t you just put two million on it? Then when you’re not there, they will do that as well. That’s what it is. So, the failings are cultural. You have to be true to yourself. And that’s what it is. People can say, oh, Kola Karim is arrogant. No, I’m not. I can’t steal from myself. The business belongs to us. So why should I either aid you to steal from me, and you’ll give me a cut? It makes no sense. I’ve seen it so much here. The business that belongs to you, someone is supplying you with a car that’s two million and four million. And now say they’re going to bring you something. You’re stealing your own money. It makes no sense. Why didn’t you just tell the CFO, ‘transfer the money to my account?’ So I see that all the time here, and I laugh. So when people come to me with transactions, that’s why people think, oh, he’s arrogant. I’m not interested because I can’t steal from myself. You see, the more we have that logical thinking, the better. See, I don’t mind giving you a deal because you’re going to make money. After all, nobody does anything for free, but I will not give you a transaction to make excessive money on me with the hope of you coming to give me something. I can as well take my own money myself. So that’s the mistake I see a lot of businesses, a lot of business leaders make. They steal from themselves, directly or indirectly. And I cannot fathom why people do it. And for me, as a leader in business, that’s one culture that must go—stealing from yourself.

The energy sector is rapidly evolving. How does Shoreline Natural Resources stay innovative?

We follow the world decarbonisation. Nigeria today, the gaps, as we’ve talked about, are in our gas reserves that need to be unlocked, and we are focusing on that, looking at CNG (compressed natural gas) and gas processing as a way forward in building value. So we’re staying ahead of the curve but at the same time keeping our eyes on the crown. Nigeria has abundant gas reserves, and those gas reserves need to be monetised in a society that needs it so everything works in tandem. You’re not producing something people don’t want. This is the crazy part of where Nigeria is. You are producing something that the world needs, and yet you do nothing about it. Do you see the problem? It’s like a man has got a farm, and maise is there, and yet you just leave it and let it rot away. That’s what we’re doing to our natural resources. You see, look, I’m going to say something that might sound controversial when it comes to the Delta. I think a lot of leaders are not thinking right about the effect of not taking the security of the Niger Delta seriously. Look, the states get derivation money, but the derivation is on what is produced from your state. And if they’re causing problems to the oil company and you’re the state governor, and you sit there and say, it’s not my business, it is that of the community leaders, at the end of that month, you get less money. So it’s lose-lose. See, for some reason, leaders in Nigeria disconnect. Political leaders disconnect their minds. Let the chief in Ughelli or let the chief in Bonny deal with it. It should be your problem. So this is where I find there’s got to be a nexus between political leadership and business. It’s more so in the Niger Delta for the collective success of everyone. Look, all the pipelines have been vandalised. It’s not ghosts that are vandalising them. It’s people in communities who are aiding and abetting, but don’t tell me people do not see them. Forget security. So if I were a governor in one of the states, I would sit down with all the community leaders and kind of deal with them directly and say, chief, for each derivation from your state, this is a bonus for this local government. Do you see what I mean? Make it to the people. That’s the nexus that needs to be connected. But you know what we do here? Ah, let’s go to a security man. They’re not giving it to Chief Kola to manage it. He’ll bring his cousin and his sons. Everybody else gets nothing. Then, when they go to Austin tomorrow, he’ll aid his boy. He’ll be making his own. That’s the problem. So, political leadership and the natural resource sector, that nexus has got to work. Because it’s a win-win and more so because the PIA now guarantees communities bonuses, but nobody’s explaining it to those communities. That’s why I say we’re working across purpose. This is to the community directly. It’s there. But people in the community do not know this. You see, if this is our community and they’re producing 10,000 barrels, and we’re making sure it’s safely produced, and at the end of the quarter, we’re getting this amount of money, I kid you not, people in those communities in the Delta will be walking tall. You know what I find? We’ve been in there. How many people live in those communities? They will be so successful that people migrating from the cities will be going back. Look, there are some communities. I kid you not, and they’re producing 15,000 barrels. The whole community is 500 people, including the children even chicken.

What are you talking about? It’s crazy.

The 500 there, if they have cousins, they will all go back. Once the success starts, they rush back. That’s the way society energises itself. But for some reason, everyone’s like this.

They’re not talking, not understanding each other, not working together. And the states, for some reason, I don’t get it; the majority of the state governors just think, Ah, it’s Abuja’s problem. It’s the NNPC’s problem if they’re breaking pipelines in my state. Do you see? No one’s connecting that the money I’m going to collect at the state level is going to be less. This, for me, has got to be an urgent, critical between the oil sector and public service in those oil-producing states and the interface with those communities in those producing states. Because you see, people that come to break my pipeline, and come to your village to break it, people in the village worked, aided, abetted, or pretended they didn’t see them. Do you see what I mean? Because the guy feels, after all, what do I get from here? Nothing. So what’s my own? The small the guy’s going to give me, I’m going to collect my own, look away.

But if we all know this in the collective, we’re all going to be successful, we will defend it with our last sweat. So, again, I don’t understand why people don’t see this.

You can’t tell me an oil company it is my business to negotiate with the chief of XYZ village. You’re exposing him and his people. And what will happen when he comes to my office if he takes 10,000 Naira? He will never tell them it’s the 10,000 Naira I gave him. Make it open so that everyone in the community knows they will be successful. Because you know why? The percentage stipulated in the PIA is known. So if we produce 15,000 in our community, everybody knows. Do you see what I mean? He becomes in the collective. So if the chief wants to cheat on you, you shout. This is what it is. Everyone now becomes entrenched. It’s all our own. It’s our oil. That’s when it becomes our oil. In the collective.

If you could go back in time and give your younger self one piece of advice about entrepreneurship, what would it be?

Again, still be true to yourself. Always. I see a lot of people, and I see a lot of people of our generation and the younger ones, a lot of not being true to yourself is what gets you deluded. Thinking I’ll cut corners and I’ll be rich. If you’re true to yourself, you understand your values. If you understand your values, then you have a purpose. I’ve lived in the same house for 27 years. I have nothing to prove to anyone. Before that, I lived on Ademola Street. Some people, after making small money, will go and buy land for two billion naira. Imagine Two billion naira land, then spend four billion building the house. And then some guy is selling cigarettes outside his door. That makes no sense. If you live in America, convert that money to dollars, where would you be living in Beverly Hills? It makes no sense. You own so many homes, and 10 cars. You can’t sit in more than one at a time. So if you’re comfortable in yourself and your being, you’re living in the same house. Simple. That, for me, is the way I see life. Nothing else. The rest is just fluff. Be true to yourself. See, when you start deluding yourself, it’s when, ah! I have to go to buy a big house in Banana. So they know, yes, I have arrived. Then outside your gate, one Rolls Royce here, another one there, Land Rover Jeep here. Before you look, 10 cars. Then from 10 cars, you have 10 drivers. You build a six-bedroom mansion, and you have 20 people working to clean it. It does not bother me. That’s the only car I drive. That’s all. It doesn’t matter. Because that’s not what defines who I am. If you need material stuff or visuals to define who you are, then you’ve lost every plot, and I’ve seen so many people do it, from the younger to the older to the not-so-old, to prove a point. I have nothing to prove to anybody. Nothing. Absolutely nothing to prove to anybody. Because once you’re true to yourself, you prove to yourself. Because after all, I’m the one living in my house. All these men with the big mansions he’s built, in Asokoro, in Maitama, on the hill, and everything. Are you living there with him? It’s just visuals. So you see, ah, that’s XYZ’s house. His mansion. It does not bother me. At all. So once you’re comfortable in yourself, and true to yourself, that defines leadership in any sphere.

You spend a lot of time in England. And I know that you’re a polo on player, and I also know that you’re very close to the throne now. So, I want to talk about that. How did you get friendly with King Charles and the family?

Polo is the passport to the world. If you understand the elegance of polo, polo is the only sport played that you can’t lie to people, that you’re a polo player. Do you know why? We can all pretend we buy golf apparel, whack a ball, if you like whack it the wrong way, and people go, oh, he’s a golfer. But polo, they have to give you a horse to mount. The fear alone, that’s why it’s rare to find someone bullshit as a polo player. See, polo is such a beautiful sport, and that’s why they refer to it as the sport of kings. It’s played by royalty globally. I came into riding horses here in Lagos, as a young man. And getting to England, I continued in the same tradition. And came back here, the polo is so energetic. It’s amazing what it forms into you. And that opens doors of global relationships, because polo is played, a team consists of four players, and those four players are a bond of a man and his horse, protecting and supporting the other three players on the team.

So you can imagine the bond you form. And that’s why over the years, playing in England as a member of Guard’s Polo Club, where His Majesty is the patron of the club. Before him was his mother. And that’s my involvement. Over the years, I’ve been playing tournaments with Prince William, Prince Harry, and the royal family, and for me, it’s a privilege to be in that environment. Building such formidable relationships on a global scale. And that in itself, stands out for something. It’s a sport that we kept going. We have a polo team in England, the Shoreline Polo Team. Still competing. My son plays hugely also, and it’s something we hope to continue. Because it’s a passport to the world. I’ll give you an example. Many years ago, it was about 20 years ago, we went and played in the Hamptons in the United States. And you sat there. First, it’s strange to see a black person in America playing polo. We played in 2003. Then in Virginia. We played in Charlottesville, Virginia. And these guys came. And they just start talking to you. The attraction is a black guy.

He’s not American, and he’s come to Charlottesville, Virginia, to play in a polo tournament. Who are you?

What do you do? Because polo is not a cheap sport. So you build amazing friendships and relationships that turn into business, into lifelong friendships. The same in Argentina. The same in Brazil. South Africa. In Asia, Singapore. I just went to Indonesia. And one of the prime movers of that country is a polo player.

And we got talking. I said, no, please, you must come and play with us next time you come here. So that’s why polo is referred to as a passport to the world. It’s a sport played by royalty and people of note. Middle and upper middle class globally. So it creates an exclusive grouping of people in a sport that’s dangerous. But it shows the mechanical relationship between a man and his horse. And that’s a beautiful relationship to watch, to see, to nurture, growing. And that’s the same application you apply to your daily life.

Business is mechanical. A man and his horse. A man and his business. A man and his people, his staff. Everything that you do. And that’s the love on and around horses. Think about it this way.

If you’re a polo player, it’s the mechanics between a man and his horse. You know, the only way to play is to ride that horse that takes you to play. So think if you have not fed that horse. If you have not watered that horse. Are you not putting yourself in danger? So it’s the mechanics. If that horse is not well trained, you put yourself and others at risk. If that horse is starving or not watered, you put yourself and others at risk. So the mechanics of a polo player, you can apply to everything in life. If you’re the leader of a business and your staff are unhappy, you run an unsuccessful business. If you’re the leader of a business and you’re stealing, your staff will steal. If you’re the leader of a business and you’re short-changing your customers and clients, your staff will not care. So, I apply the polo mechanics to everything I do. And that, for me, is the beauty of life around polo, a man and his horse.

Besides polo, how do you relax when you’re not working?

Look, I like my time alone. I’m a loner. I think I’m one of the few people who enjoy this time alone. I could be here for two days and not step out there. I discovered a new thing during COVID called Netflix. Oh my God. Seriously, that thing is like a drug now. I discovered it during COVID-19, and I was watching 12, 13 hours a day. I could do that. And it’s so bad now before I sleep, I’ve got to put something on before I sleep on it.

So that’s how I enjoy my time. So it’s so bad that it’s I’m unsociable. I could sit here, no kidding, without going through that door till Monday. I will watch from one Netflix to the other. And now that the football season has started, as an Arsenal supporter, we’re back on course again.

A lawyer by training, Onah packs over a decade of experience in both editorial and managerial capacities.

Nwachukwu began her career at THISDAY Style before her appointment as Editor of HELLO! NIGERIA, the sole African franchise of the international magazine, HELLO!

Thereafter, she served as Group Editor-in-Chief at TrueTales Publications, publishers of Complete Fashion, HINTS, HELLO! NIGERIA and Beauty Box.

Onah has interviewed among others, Forbes’ richest black woman in the world, Folorunso Alakija, seven-time grand slam tennis champion, Roger Federer, singer Miley Cyrus, Ex Governor of Akwa Ibom State, Godswill Akpabio while coordinating interviews with Nigerian football legend, Jayjay Okocha, and many more.

In the past, she organised a few publicity projects for the Italian Consulate, Lagos, Nigeria under one time Consul General, Stefano De Leo. Some other brands under her portfolio during her time as a Publicity Consultant include international brands in Nigeria such as Grey Goose, Martini, Escudo Rojo, Chivas, Martell Absolut Elix, and Absolut Vodka.

Onah currently works as the Editor of TheWill DOWNTOWN.